Combining Strengths to Compete with Industry Giants

JetBlue’s acquisition of Spirit brings together the complementary strengths of both airlines. Known for its low fares and high-quality customer experience, JetBlue has built a reputation as a reliable and affordable airline since it began service in 2000.

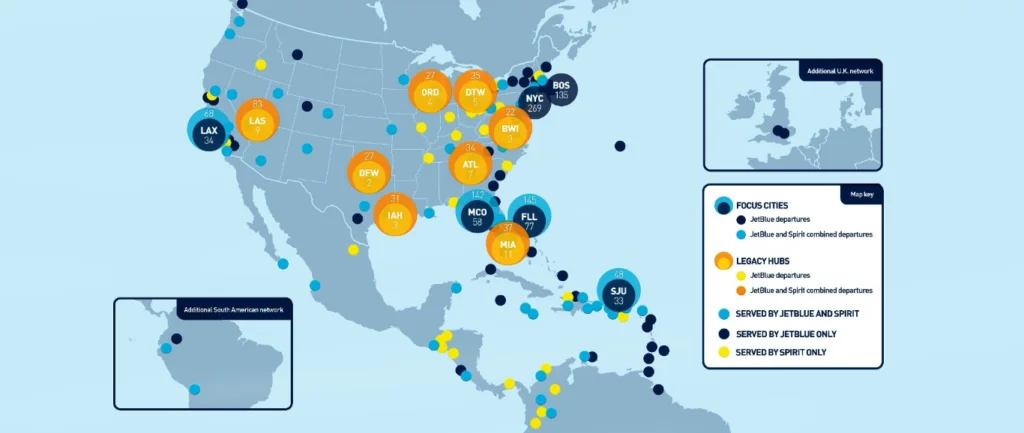

The integration with Spirit, a pioneer in ultra-low-cost flights, expands JetBlue’s ability to offer affordable travel options across major U.S. hubs, including Boston, Fort Lauderdale, Los Angeles, Orlando, and San Juan. With over 22,000 dedicated crewmembers, JetBlue’s award-winning service will now be accessible to more travelers in traditionally underserved markets.

JetBlue employs

Cities in the United States

Clients

Expanding Low-Fare Options with the “JetBlue Effect”

One significant impact of this merger is the expected expansion of the “JetBlue Effect.” Historically, when JetBlue enters a new route, it disrupts fare patterns, prompting legacy carriers to lower their prices. Economic data supports this trend, showing a fare reduction of approximately 16% on nonstop routes where JetBlue competes with major carriers. This price drop benefits consumers by making air travel more accessible and affordable.

Bringing the Best of Both Airlines to More Destinations

The combined JetBlue-Spirit airline promises to increase route offerings, extending JetBlue’s services to more regions and customers. Together, they’ll reach destinations across North and Latin America, the Caribbean, Canada, and Europe, including key U.S. hubs where low-cost options are limited. This broader reach will provide customers with more choices for affordable travel, giving them the flexibility to explore new routes at competitive prices.

Expanding Route Offering

Reaching New Destinations

Addressing Limited Low-Cost Options

Flexibility and Competitive Pricing

Improved Customer Experience and In-Flight Service

JetBlue’s commitment to exceptional customer service, from booking to arrival, will be extended to Spirit’s passengers, enhancing the overall travel experience. JetBlue’s signature in-flight features, such as comfortable seating, free snacks, and onboard entertainment, will likely be adopted on many Spirit flights, combining affordability with added value. This merger allows JetBlue to introduce its unique service model to a wider audience, meeting the needs of travelers who want both value and comfort, making it a highly attractive choice for budget-conscious passengers.

New Partnerships in the Skies: JetBlue, Spirit, and Spribe

The JetBlue-Spirit merger brings exciting opportunities, including a unique partnership with Spribe, creators of the popular Aviator game. This collaboration focuses on integrating gaming into the travel experience, offering passengers enjoyable activities both in lounges and during flights. The goal is to provide an engaging environment where travelers can relax and explore Spribe’s mobile games as part of their journey.

As an added bonus, passengers who show the Aviator app installed on their phone will receive complimentary access to the JetBlue Business Lounge. This initiative combines entertainment and comfort, enhancing the overall experience for those waiting for their flights.

Potential Challenges and the Path Forward

While this merger holds significant potential, challenges remain. Regulatory authorities will closely examine the merger to ensure it aligns with consumer interests. Additionally, integrating two different operational systems and cultures could pose logistical hurdles, requiring careful planning and collaboration. However, with a clear vision and strategy, JetBlue is optimistic about overcoming these challenges and looks forward to creating an enhanced, customer-centered airline that reshapes the U.S. air travel landscape.

How the JetBlue–Spirit Merger Will Change Your Flying Experience

When two major airlines join forces, it’s not just a business deal—it directly impacts millions of travelers. The merger between JetBlue and Spirit Airlines is one of the biggest shakeups in U.S. aviation in recent years, and it’s set to redefine how people fly, especially when it comes to routes, schedules, and service standards. So,…

The Competitive Effect: How a New Player Shakes Up the Market

When a new airline steps onto a route, something interesting tends to happen—prices drop. That’s no coincidence. The recent JetBlue–Spirit merger is more than a corporate power move; it’s the creation of a fresh force in U.S. aviation, one capable of reshaping competition across dozens of routes simultaneously. This new airline presence brings a powerful…

Airline Mergers and Jobs: What It Means for the Workforce

When two airlines merge, the headlines usually focus on fleets, routes, and fares. But behind the scenes, the ripple effect is much broader. A merger reshapes thousands of careers—from flight attendants and pilots to technicians and back-office staff. In the case of JetBlue and Spirit Airlines, more than 30,000 employees are part of this transformation.…